With over 800,000 Australian borrowers facing expiring fixed-rate mortgages just as interest rates rapidly rise, Perth buyers have critical financing decisions ahead.

While Perth’s market remains resilient with prices up 10.8% annually amid population and job gains, repayments are still set to increase by thousands per month for many.

Despite this, Perth home prices are still relatively affordable versus incomes, meaning the Perth property market poses unique opportunities compared to similar capital cities across the country. Our steady economy also supports more price growth, making now the best time to buy.

At Strategic Mortgages Perth, we aim to provide reassurance that our extensive experience navigating this landscape means we can guide you to balanced, informed choices when it comes to mortgage and finance solutions. Whether you’re an investor or first home buyer, our experts understand how to balance pragmatism with empathy when exploring your options.

The WA capital city offers opportunities for first-step purchasers to serial investors. Let’s demystify your mortgage and finance solutions in Perth so you can build long-term wealth safely.

Mortgage and Finance Selections in Perth

Buyers in Perth have access to a wide range of home loan and financing solutions to fit their budget, lifestyle, and future goals. When assessing your options, there are a few key categories of products, which we cover below.

Variable Rate Mortgages

The most common type of mortgage comes with an interest rate that fluctuates based on market conditions and the cash rate. Payment amounts can go up or down over time. Pros include flexibility, no lock-in contracts, and often lower rates. Cons are the risk of increasing payments if rates rise significantly.

Fixed Rate Mortgages

These lock you into the same interest rate for a set period, often 1-5 years. Pros include payment security and the ability to fix at low rates in down markets. Cons are penalties for early termination and missed savings if rates fall.

Split Rate Mortgages

A hybrid product splitting your loan between fixed and variable portions lets you hedge risk while capitalising on market swings in your favour. This balanced approach provides both payment stability and flexibility.

Alternative Document & Low Document Mortgages

If you’re self-employed, a contractor, or have irregular income streams, alternative document loans use wider income verification methods beyond payslips. This helps non-conventional borrowers qualify for a mortgage.

Consider economic forecasts and where experts expect rate movements when choosing variable or fixed products. Models suggesting that interest rate decreases ahead favour variable loans, while expected hikes support fixed loans.

Strategic Mortgages Perth delivers deep expertise across these key mortgage and financing products – whether you’re after a smart investor or looking to beat rising rents and start building wealth.

Discover more details on our home loan brokering services by booking a no-obligation consultation here. Our team of specialists is ready to match you with the optimal local or national bank lenders and mortgages, enabling your financial goals.

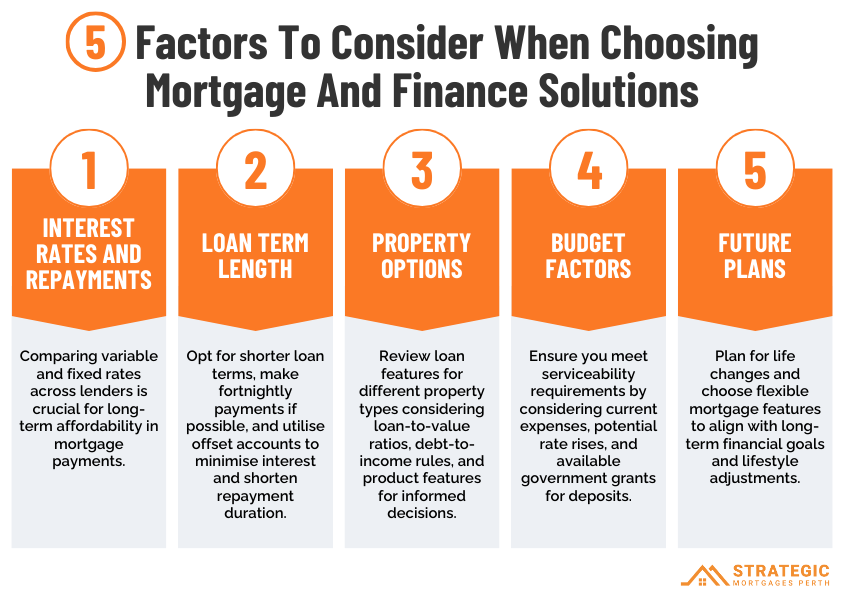

Factors To Consider When Choosing Mortgage and Finance Solutions

Finding the right loan product goes beyond interest rates to suit your wider financial lifestyle and goals.

Key factors to weigh up include:

Interest Rates and Repayments

Loan rates dictate your monthly and long-term costs, with these rates and features varying dramatically across lenders. It’s important to thoroughly compare variable and fixed rate options using comparison tools, or with the help of your Perth mortgage broker. You’ll want to watch for hidden fees and fine print, compare variable and fixed rates across lenders, and get multiple quotes before deciding. Importantly, make sure you can afford payments over time, even if rates rise.

Loan Term Length

Longer terms of 25-30 years, the most common for Perth homeowners, may have lower monthly costs, but come with a higher total interest paid. Where possible, opt for shorter terms to pay loans off faster if you can afford fortnightly periodic payments. You should also consider setting up an offset account. While this does not reduce the amount of repayment you make, it can significantly reduce the duration and total interest you pay on your loan, which is always a win.

Property Options

The loan you need depends on the type of property you’re looking at. Review loan-to-value ratios, debt-to-income rules, and product features for land versus established homes, houses versus apartments, investment properties, and new builds.

Budget Factors

Be sure to account for current expenses and financial obligations alongside loan repayments to confirm you meet serviceability requirements. Include potential rate rise buffers and cost of living adjustments over the long term.

While 20% deposits reduce rates, smaller deposits as low as 5% may work by if you’re willing to pay mortgage insurance. While counterintuitive, sometimes opting for a lower deposit can be worth it to get in the market faster, so make sure you compare the benefits of saving longer versus buying sooner at higher payments. If you are a first home buyer, you may also be eligible for various Government grants, such as the First Home Buyer Guarantee (FHBG) and stamp duty concessions, reducing the amount of budget you need upfront.

Future Plans

Consider future life stage plans that could impact finances—from career moves, expanding your family, potential renovations, and more. Evaluating these elements will guide you to mortgage products aligning with your financial situation, risk appetite, and personal lifestyle goals over both the short and long term. Look to opt for loan features that offer flexibility for life changes.

Benefits of Our Customised Mortgage and Finance Solutions

Led by Trent Fleskens, one of Perth’s leading property commentators regularly featured across Channels 7, 9, and The West Australian for his market insights, our solutions deliver value beyond the transactional.

We start by understanding your priorities first—from budget through to lifestyle and future goals. Our team of mortgage finance brokers in Perth has intimate local property knowledge. Whether you’re buying your first home, refinancing or expanding an investment portfolio, we match mortgage products and loan terms to your finances and risk appetite.

Our guidance is educated by boots-on-the-ground expertise – not just data sheets. Trent translates market trends into informed recommendations on seizing opportunities and avoiding pitfalls.

The result is straightforward strategies drawing from unrivalled front-line experience. From first home buyers and investors to refinancing – our team has assisted them all. Let our practical insights guide your next chapter.

Unlock Your Financing Potential with Perth’s Top Mortgage Brokers

Perth still presents opportunities for savvy buyers and investors amidst complex conditions. Yet realising value hinges on selecting the right loan product and terms for your situation.

With intimate market knowledge and over two decades of collectively guiding clients, Strategic Mortgages Perth promises obligation-free strategies tailored to your priorities. Get in touch today via our online form or by calling (08) 6154 2613 to request a free, no-strings-attached consultation.