The average mortgage interest rate in Australia fluctuates constantly. Monthly, it is influenced by a range of economic factors such as inflation, growth, unemployment and government policy. As a critical factor in the decision-making process of homeowners and investors, this brings some difficulty, but understanding the larger patterns can help provide clarity for better-informed financial decisions.

As experienced Perth home brokers, finding and securing home loans across over 30 lenders, we can provide expertise and current advice on this topic, seeing the fluctuations in home loan interest rates, and in the Perth property market, year-on-year.

In this analysis, we share our expertise with you. Leveraging statistics on the current average mortgage interest rate in Australia according to recent data from the Reserve Bank of Australia (RBA) and discussing it’s past, present and future.

What is the Average Mortgage Interest Rate in Australia for 2024?

For first homeowners and owner-occupied dwellings

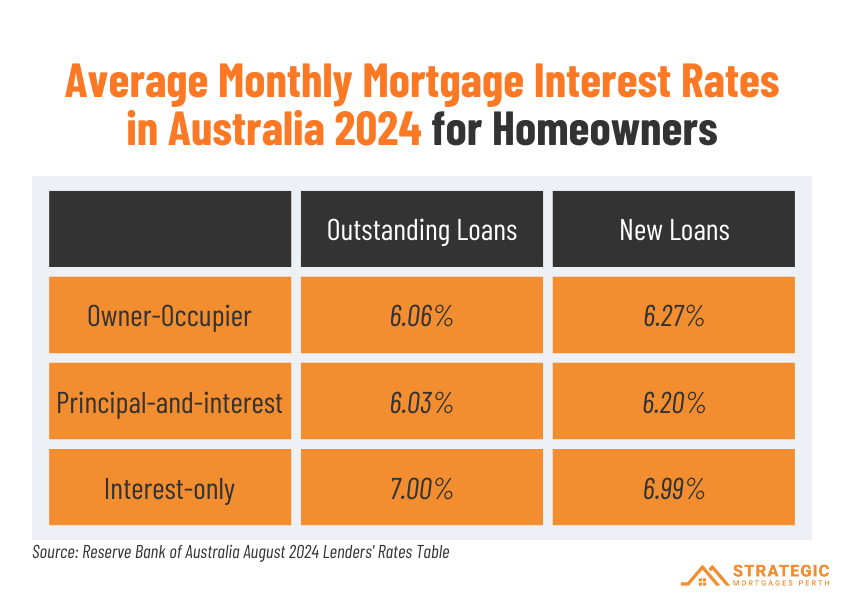

According to recent data released by the Reserve Bank of Australia (RBA) for August 2024 (released September 25th, 2024), the average monthly interest rate in Australia is 6.27% for owner-occupied loans.

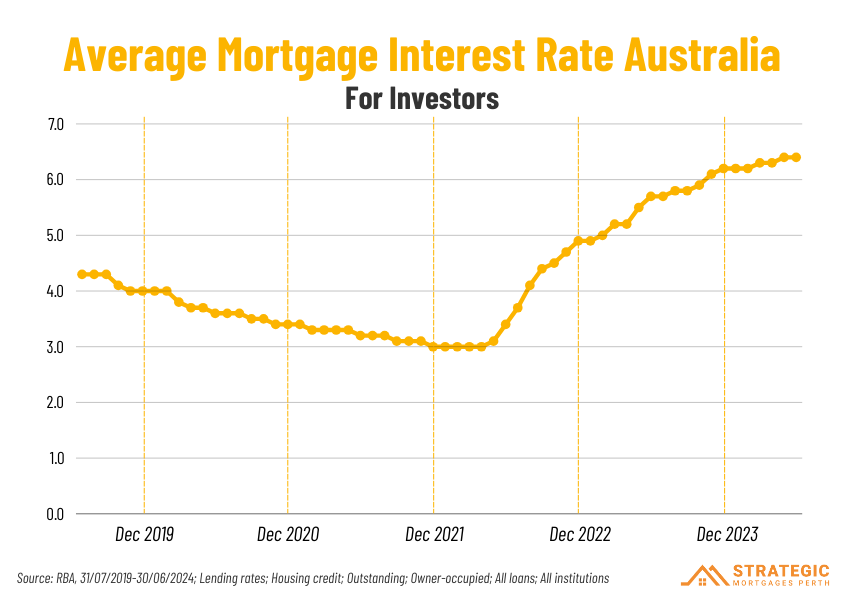

For investors

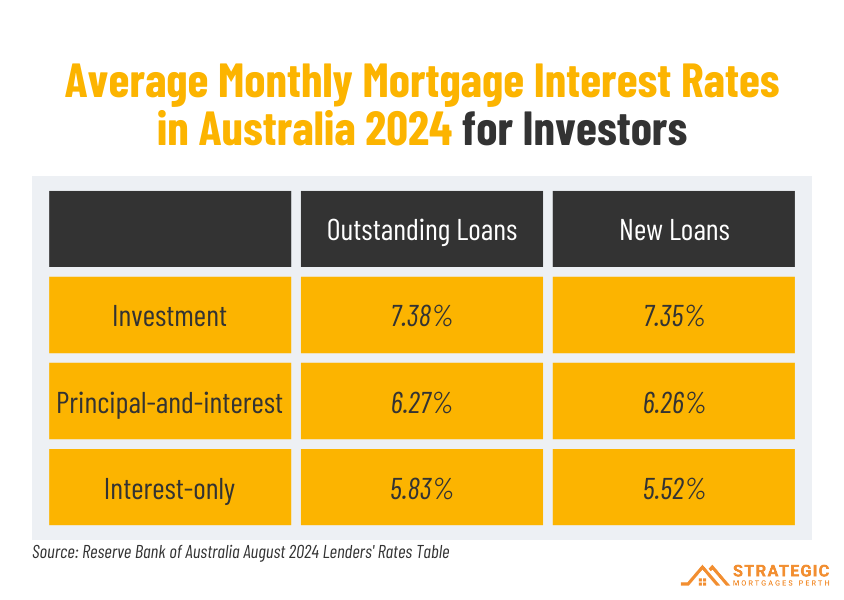

According to the latest data released by the Reserve Bank of Australia (RBA) for August 2024 (released September 25th, 2024), the average monthly interest rate in Australia is 7.35% for investment loans.

Australia’s Interest Rate History

2019 – Present

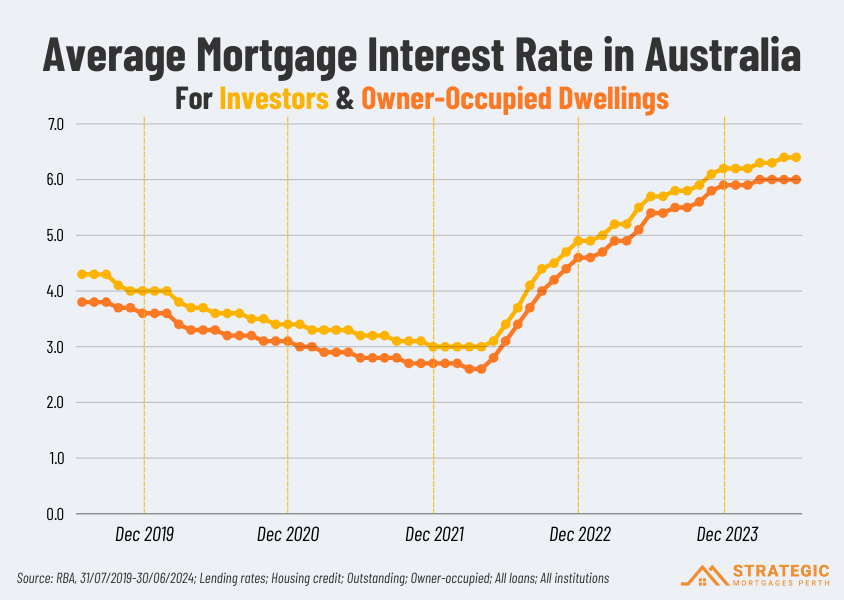

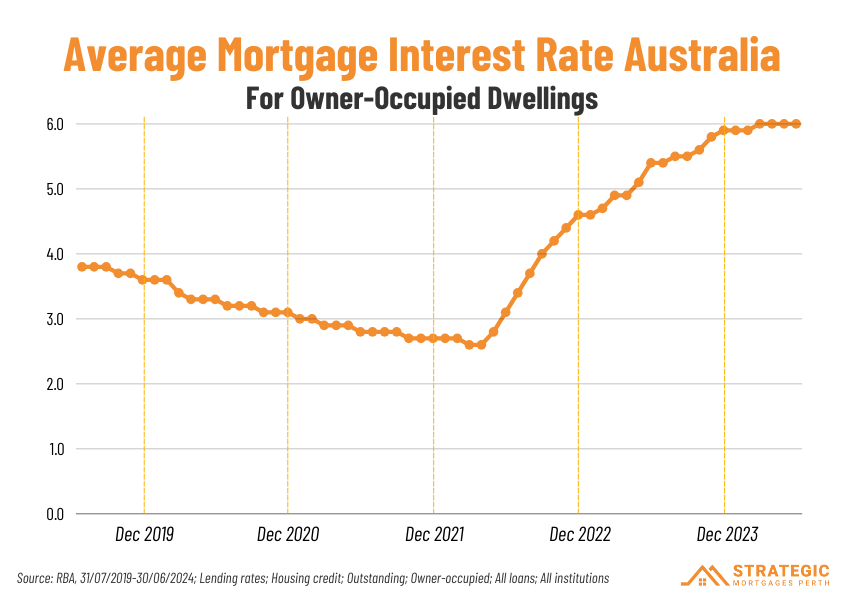

According to data from the RBA, in July 2019, the average mortgage interest rate in Australia for owner-occupied dwellings was sitting at 3.8%*.

While low even by today’s standards, the wake of COVID-19 caused a shift in Australia’s monetary policy which would see this rate take a continuous decrease. As the Reserve Bank of Australia sought to stimulate the economy with a lowered cash rate, we saw lowered interest rates across the board, improving interest rates in the eyes of homeowners and borrowing businesses.

In mid-March of 2020, an emergency meeting by the Reserve Bank of Australia cut the cash rate to a historic low of 0.25%, causing average home loan interest rates in Australia to further decrease to 3.4% and 3.8% for owner-occupied and investments respectively.

In early November, further aggressive monetary policy was used, with the RBA announcing a cash rate target of only 0.10% where it stayed until early April 2022. In the graphs below, we see that, as expected, the average mortgage interest rate in Australia remains low throughout this period, only starting to rise in May of 2022 in a delayed response to the April cash rate target rise.

*This data accounts for all loan types (such as variable and fixed-rate) and all institutions (including small and large banks).

1959 – 2020

The threat of rising average mortgage interest rates in Australia is continuously a hot topic of discussion amongst homeowners, financial analysists and economists but it’s important to put into perspective that in the 21st century we have been experiencing record-low average mortgage interest rates in Australia.

Between 2009-2020 this was especially true, with the average home loan interest rates for owner-occupied home loans** hitting a high of just 7.79% but a historic low of 4.52%. This is a full 0.48% less than 1964 which previously held the record for lowest interest rate up until July 2019 where interest rates fell to 4.94%.

Despite the interest rate of 1959 and 2019 being near equal, the interest rate change between these two has shown great volatility.

In 1973 the interest rate surpassed the 8% threshold holding 8.38% interest between Oct 1973 and Jun 1974. By March 1982, the interest rate rose to as high as 13% and continued on a staggered upward trajectory to 17% in June 1989. Since 1989, the interest rate hasn’t been close to this extreme, with a sharp drop after this point, the average mortgage interest rate in Australia returned to around 10.5% in June 1995.

**For variable standard loans provided by banks – this is the longest running mortgage average interest rate data set from the RBA.

The Future of Australian Interest Rates

Since the end of lockdowns, and the RBA’s record-breaking 0.10% cash rate target, the cash rate, along with the average mortgage interest rate in Australia has been slowly trending upward. In the wake of the pandemic, the cash rate shot quickly upward to return to “normal” levels, moving from 0.85% in mid-2022 to 4.10% in mid-2023.

Today the volatility is now at rest, with the cash rate target being settled at 4.35% since November 2023. Following this sharp incline, we can now expect less significant change in Australia’s average mortgage interest rate over the coming years, with a more settled cash rate.

With that in mind, there are several economic concerns currently sitting with the RBA impacting the expected average mortgage interest rate for 2026.

How High Could Interest Rates Go in 2025?

The August 2024 statement by the Reserve Bank Board noted that Australia’s economic outlook was uncertain and raised concerns about settling inflation back to target, describing the return as “slow and bumpy”. This may provide some evidence to the fact that the RBA will rise interest rates in the coming year to bring inflation down, but many experts are not concerned with this factor.

Luci Ellis, former assistant governor (economic) at the Reserve Bank, now at Westpac, is predicting a slash in the cash rate to 3.6% which would see mortgage interest rates decrease. Su-Lin Ong of RBC Capital Markets calls the RBA a “reluctant hiker” and takes the opinion that their focus on keeping unemployment low will outweigh their concerns of inflation, even if it is not completely within the bank’s target.

Do Better Than the Average

Depending on your personal financial goals and situation, you can expect a different estimated interest rate on your mortgage from the national average. If you want to do better than the average person in your position, the trick is to work with local Perth home brokers.

Our team compares loans on your behalf across more than 30 lenders providing loans on Perth mortgages, to ensure that you get the very best deal possible. With decades of combined industry expertise, we make sure that you are settled with a loan that doesn’t just have a leading low interest rate, but that also prepares you for success and security.

Keen to get started? Speak with our team today to refinance your home loan or investment property.

Find the data used in this article here on the RBA website.