Calculating mortgage repayments, and understanding your mortgage’s ongoing expenses, are crucial for ongoing financial planning and comparing different mortgage and lender options.

As leading mortgage brokers in Perth and holding relationships with over 30 lenders, we have helped thousands of Perth residents understand their mortgage options and repayment plans. Going beyond what one-dimensional online mortgage calculators can offer, we provide our clients with rich insights into their mortgage repayments, setting them up for financial success.

In this guide, we share our insights to help you make informed decisions about your home loan. Whether you’re a first-time home buyer or considering refinancing your Perth home loan, our guide will help you understand the complexities of calculating mortgage repayments.

- Ongoing Home Loan Fees

- Mortgage Repayment Calculators

- Frequency of Mortgage Repayments

- How to Reduce Your Mortgage Repayments

Ongoing Home Loan Fees & Costs

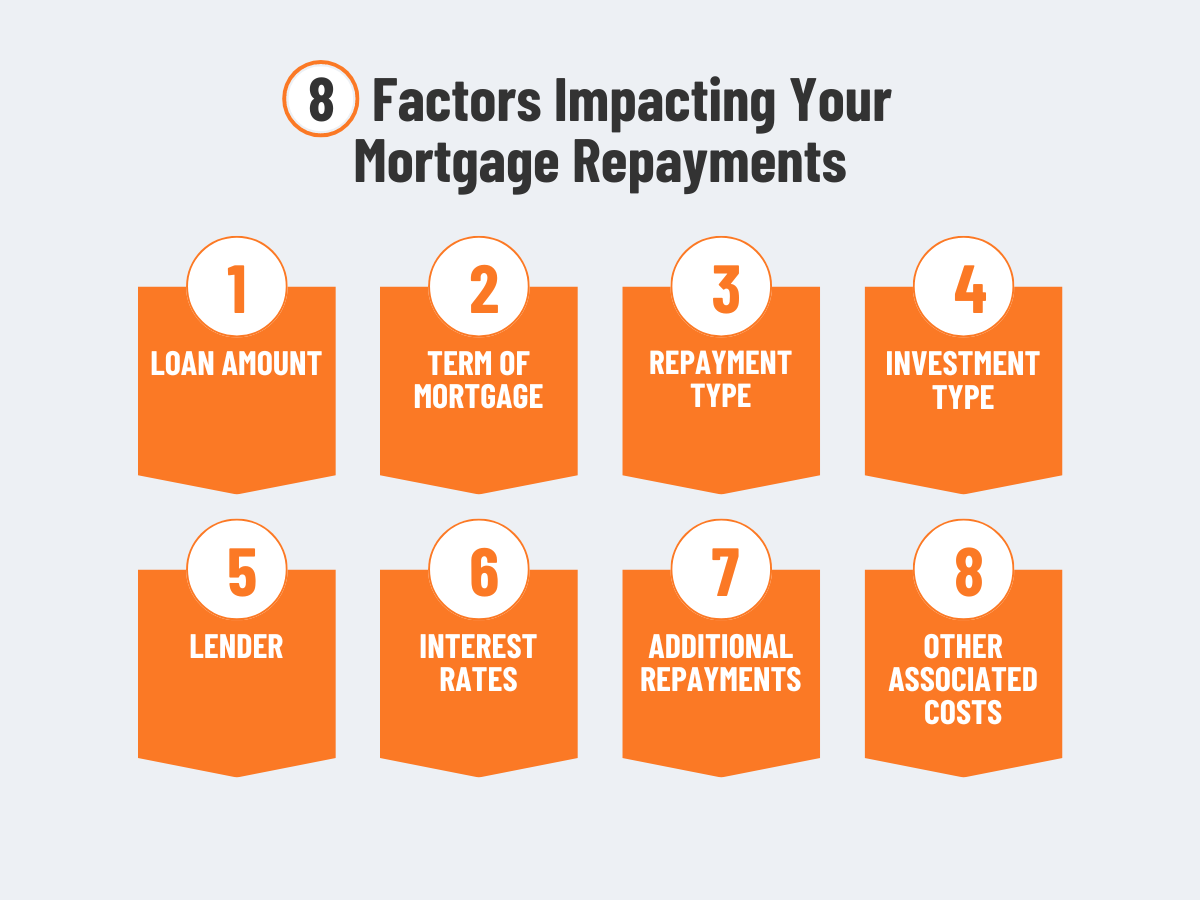

When calculating mortgage repayments, ongoing fees and costs should not be excluded.

Depending on your chosen home loan, there are associated costs worth considering. To stay ahead on your finances, ensure you accurately account for these costs when calculating your mortgage repayments and ongoing expenses.

Monthly service fees

A monthly service fee, otherwise known as a monthly maintenance fee or loan service fee, is a monthly fee that covers the cost of administering your home loan. This is true for most home loans, though under certain conditions, the banks may waive this fee if you meet certain requirements.

Annual fees

If your mortgage is part of a package deal you may be subject to annual fees. The amount may change depending on the loan products, amount, lender and interest rates,

Late payment fees

Being charged for late repayments is an additional cost associated with not submitting mortgage repayments on time. This cost is largely avoidable, with many lenders providing a grace period after the due date, to allow for extenuating circumstances.

The amount owed and grace period can change substantially between providers, with some lenders offering a grace period of up to 14 days and others allowing five.

With CommBank as an example, the late payment fee is a flat $20 on top of your home loan and is due within five days. This fee continues to be charged until the outstanding amount is paid. While only a small amount, caution is advised as it has the potential to have a substantial impact. Falling behind on repayments may also impact your future borrowing, so it is always best to plan when it comes to your repayments.

Switching fees

If you decide to switch from your current mortgage plan to a different mortgage plan under the same lender, then you will be subject to switching fees. If done correctly, the savings you make from switching will outweigh these costs and you will save money in the long-term.

Portability fees

Just because you took out a home loan on one house, doesn’t mean you’re stuck in that house forever. Subject to a small fee, you may be able to switch out the security held against your home loan, allowing you to buy and sell a new property during the mortgage period.

Additional repayment fees

Depending on the conditions of your mortgage, you may be subject to a penalty fee just for making extra repayments on your home loan. Most mortgages will allow you to go a certain percentage over the expected repayments, such as up to five or ten per cent. Beyond that, a fee may be charged for further additional payments. For variable mortgages, this fee will not apply, with many lenders offering unlimited repayments.

Using Mortgage Repayment Calculators

Many major lenders and banks provide online mortgage repayment calculators that help borrowers understand their potential repayments before committing to a plan. Some popular mortgage repayment calculators are:

- CommBank’s Mortgage Repayment Calculator

- NAB’s Home Loan Repayment Calculator

- ANZ’s Home Loan Repayment Calculator

Other lenders offering mortgage repayment calculators include Westpac, Aussie, ING, Bankwest and St.George. If you currently have a home loan set up with a provider who is not on this list, view their website to see if they have a repayment calculator available.

If you’re having trouble finding accurate repayment calculators, or find the process confusing, consider speaking with mortgage brokers in Perth to understand how to optimise your current mortgage plan.

How Frequent Are Mortgage Repayments?

Most lenders are flexible on the schedule of your repayments, leaving it at your discretion to decide which repayment schedule works best for you. When you set up your home loan, you will be given the option of monthly, fortnightly or weekly repayments.

While monthly repayments are the most common, paying weekly or fortnightly can help you save money on your home loan and pay your mortgage off earlier.

To decide which option is right for you, consider:

- Your income cycle – matching your repayment schedule with your income can improve your ease of budgeting and make repayments easier to pay off one time.

- Your potential savings – work with a financial expert or Perth home broker to calculate how much money you could save for each repayment plan.

- Personal financial goals and plans – if you’re aiming to be debt-free as soon as possible, then more frequent repayments may be suitable but if you care most about your financial liquidity, then monthly repayments can provide more freedom.

Will These Mortgage Repayments Change Over Time?

In most cases, mortgage repayments will change over time to some extent. There are some exceptions for fixed-rate mortgage repayments, if this is committed to throughout the entire life span of the mortgage. However, even fixed-rate mortgage repayments have the potential to change depending on the circumstances. Below we cover some common reasons that mortgage repayments change over time.

Variable interest rates

The majority of owner-occupied loans in Australia are for a variable home loan. For these loans, the repayment amount will change depending on the interest rate. During times when the interest rate is lower, this will cause lower mortgage repayments, which can help you save money.

Your loan repayments are interest-only

Home loan repayments include principal and interest, where the principal refers to paying off the amount you have borrowed, and the interest is the amount charged to you by the lender.

You may have the option to make interest-only repayments for the starting portion of your loan period. In this scenario, you are paying the interest portion of your loan for the set period. Following the end of this period, your mortgage repayments will increase as you begin to pay off the principal.

Your loan term has changes

During the span of your mortgage you may decide to extend or shorten your loan term, subject to approval by your lender. As a result of this change, your repayments will consequently increase or decrease.

You’ve made extra repayments

Common with variable-interest home loans where additional repayments are often unlimited. Additional repayments throughout the span of your mortgage can subsequently lower your future repayments.

How to Reduce Your Mortgage Repayments

Have you calculated your mortgage repayment amounts and you’re unhappy with the result? There are steps that you can take to lower your rate and repayments.

Seek alternatives

Whether you are looking for a better plan for your first home loan or looking to switch from your current loan, there are options available.

Consult with an expert before picking your home loan

As a home buyer, it’s not always easy to see which options are available. Working with a Perth home broker can give you confidence that you have selected the best mortgage suited to you. A mortgage broker ensures you get the ideal mortgage suited to your personal and financial goals. As part of working with a Perth home broker, you receive:

- Expert financial guidance that helps you understand your home loan.

- Access to a wide range of lenders and loan products.

- Assistance with paperwork and streamlined application processes.

- Local market insights specific to Perth’s unique property landscape.

- Ongoing support and advice throughout the life of your loan.

Refinancing your current loan

A home loan and your interest rate is something you should always be checking, to see if it is worthwhile exploring refinancing your home loan. Refinancing means changing your mortgage for a better option, increasing your household’s cash flow to be in a comparably better financial position.

Refinance or secure your home loan

Ready to take the next step towards securing your best possible mortgage? All it takes is one quick call.

Our team of expert Perth mortgage brokers combines in-depth local knowledge with access to over 30 lenders to provide our clients with their best possible financial outcome. As leading professionals in home loans and refinancing current mortgages, our professional, client-focused team can assist with calculating mortgage repayments and matching you with a better financial solution.