The amount you can borrow for your mortgage, also known as your borrowing power or capacity, depends on various personal and economic factors. While online calculators can provide estimates, they often don’t capture the full picture.

As the top mortgage brokers in Perth boasting 25 years of combined experience, we understand the complexities in determining borrowing capacity and how various factors impact the final figure. This comprehensive guide aims to help those seeking a home loan in Perth. While it can’t replace personalised advice, we hope it will assist you in making an informed choice about your home loan.

- Factors Impacting Your Borrowing Power

- How Do Lenders Calculate What I Can Borrow?

- When to Think About Borrowing

- How Much You Can Borrow on Your Salary [Estimates]

- How Much You Can Borrow if You Have an Existing Mortgage

- The Best Way to Borrow

Factors Impacting Your Borrowing Power

Understanding the key factors that impact your borrowing power is crucial to developing an understanding of what your potential home loan might look like. Here, we’ve compiled a small, non-exhaustive list of some of the biggest factors we’ve seen as Perth home brokers in our discussions with over 30 home lenders servicing the local market.

1. Income

Income is one of the first, and most influential factors that a lender will look at. Here, lenders will look at your regular salary, as well as any additional income you may have such as:

- Rental income

- Government benefits

- Interest and dividends

Income Stability

A high income may not be enough to get you the home loan you desire. If your income is unpredictable or fluctuates significantly, then your eligibility to repay the loan may be called into question.

2. Expenses

When we talk to Perth borrowers about their expenses it is the recurring essential expenses that often come to mind such as groceries, petrol, bills and utilities. While these expenses play an essential role in determining your borrowing power, lenders have a few extra considerations when it comes to expenses:

- Number of dependents – any family members who are dependent on you financially will be considered in your profile of overall expenses.

- Loan repayments – other loans you may have can include car loans, personal loans, and joint loans.

- Existing mortgages – if this is your second, third, or fourth mortgage this will be considered in your application.

- Monthly commitments – expenses that are constant and unchanged but don’t make up your essential living such as gym, streaming or online subscriptions.

3. Reason for Borrowing

When taking out a home loan, lenders will take into account whether you are borrowing to fund your own home or whether it is to fund an investment property.

If you have already taken out a mortgage for your home, and are now looking to fund an investment property, your borrowing power may decrease. This may happen due to:

- A higher perceived risk of defaulting on the loan compared to an owner-occupied home loan

- A lack of government incentives which would otherwise apply to first-home buyers

- Estimated calculations of the properties expected returns, vacancy periods and risks

How Do Lenders Calculate What I Can Borrow?

In simple terms – lenders calculate what you can borrow based primarily on your income and expenses. These two factors are what will help them determine whether or not you will be able to repay the loan effectively.

The reality however is that it’s not simple. From our vast experience securing mortgages for Perth buyers, across an extensive range of property prices from Applecross to Morley, we understand that there’s a lot more that goes into calculating your maximum buying power. As trusted mortgage brokers in Perth, we’ve seen how personal guidance, relationships, and market knowledge play a significant part in your borrowing power.

When to Think About Borrowing

It’s never too early to start thinking about borrowing, even if you might not be ready to borrow just yet. Knowing what your home ownership or investment goals are and what’s required to get you there is valuable information to have no matter what stage you’re at.

6 signs that you might be ready to start considering a mortgage for your first home

- You have a stable and consistent income source.

- You’ve accumulated a decent amount of savings and can afford a 20% deposit on a potential home.

- You have a clear understanding of your month-on-month expenses and they are consistent.

- You are clear of all, or the majority, of your existing debt.

- You feel emotionally and financially prepared for the long-term commitment of home ownership.

- You believe homeownership aligns with your goals.

6 signs that you might be ready to start considering a mortgage for an investment

- You have a solid financial foundation and consistent income

- You have paid off your owner-occupied mortgage.

- You have a thorough understanding of the responsibilities of an investment property and are prepared to take them on.

- You believe property investment aligns with your goals.

- You have a solid understanding of the current property market.

- You have consulted with financial professionals

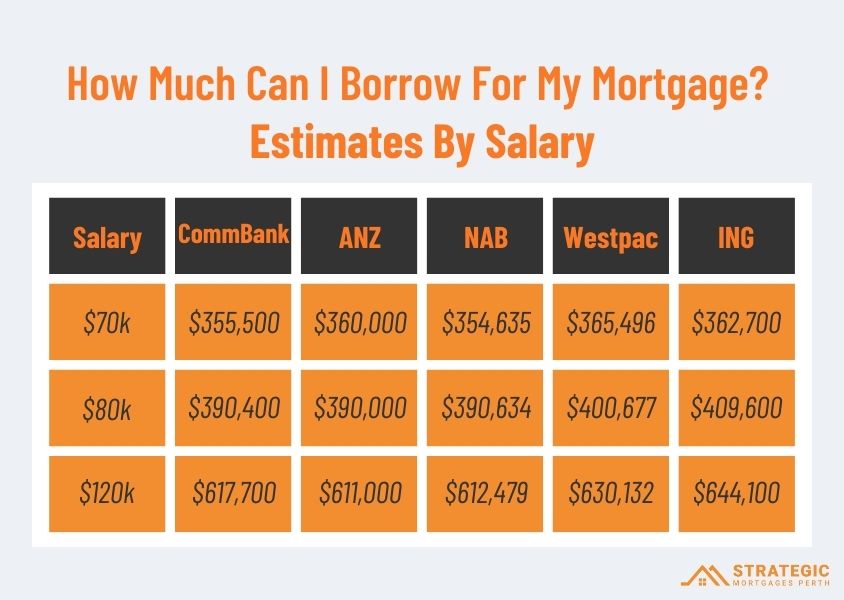

How Much You Can Borrow on Your Salary

Obtaining online estimates does not always accurately reflect your true borrowing power but they can be helpful in helping you understand a ballpark figure on what your future Perth mortgage could look like.

Below, we’ve compared potential mortgage amounts across five different major banks, to help you see your opportunities at a glance*

*Estimates are obtained for a single person with average estimated costs of $1,651 per month with no dependants looking for a $500,000 home and holding a $100,000 deposit. This person has no car or personal loans and all salary information is before-tax. All advice is general in nature and does not replace professional quotes or financial advice.

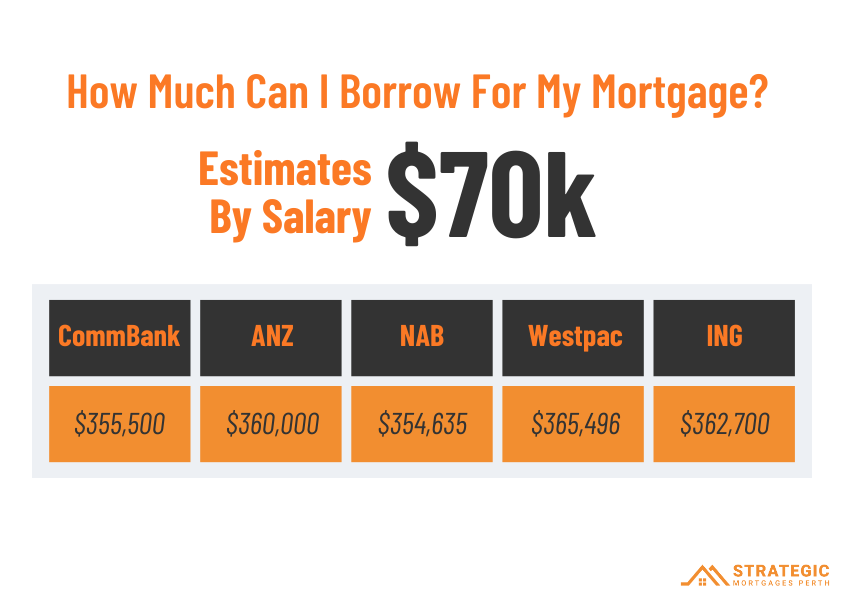

Borrowing Available for a 70k Salary

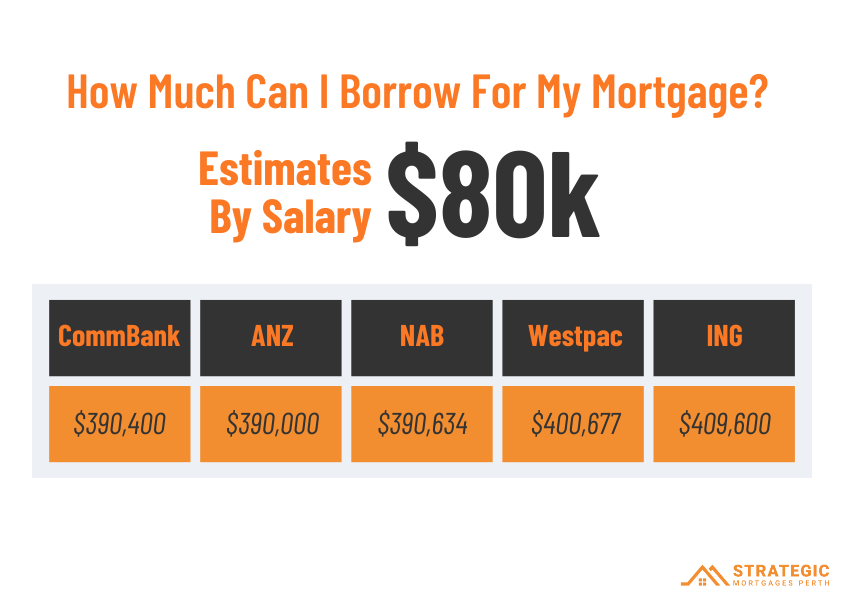

Borrowing Available for an 80k Salary

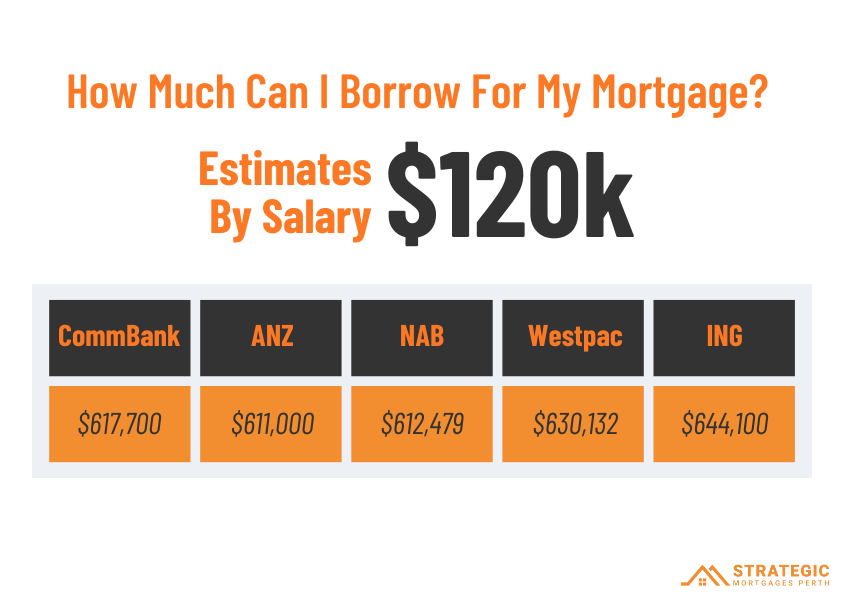

Borrowing Available for a 120k Salary

How Much You Can Borrow if You Have an Existing Mortgage

Similar to getting your first mortgage, the amount that you can borrow will heavily depend on your incoming and outgoing expenditures.

If you’re borrowing with an existing mortgage some factors that impact your borrowing rate could be:

- Your repayment history to date.

- The amount of equity you have built in your current property.

- The conditions of your current mortgage including the size of your mortgage repayments and conditions of your loan.

You Deserve To Compare More Than 5 Lenders

While you might find that a mortgage from one of the above lenders works for you, the amount of options that are available to you go far beyond them.

Led by Trent Fleskens, channel 9’s property guru, our team has built outstanding relationships with over 30 lenders servicing mortgages in Perth. These relationships, paired with our expert knowledge, is part of what allows our Perth home brokers to find better deals for local borrowers that save them time and stress in the long run.

Don’t settle for comparing mortgages across six major banks, getter a better deal, with a dedicated team whose job it is to compare every possible mortgage for you.