The process of buying a home in WA can be overwhelming. For first-home buyers especially, the process of navigating between home loans and real estate agents, all while balancing the advice of family and friends alongside your interests and values, is no easy feat. That’s why many experts and homeowners recommend the assistance of a mortgage broker when securing a home loan.

However, this advice can often be met with a question: “What does a mortgage broker do?”.

With an aging younger population and multiple federal and state-level incentives for first-home buyers released in the last few years, many Perth residents are now embarking on their first mortgage.

At Strategic Mortgages Perth, we want to help these buyers on their home-ownership journey. Through our expertise, we help people in Perth secure the best possible outcome while providing clarity across the whole process. From start to finish, we make it easy, and while that’s a big part of what we do as leading Perth home brokers, it’s not all we do.

What does a Perth mortgage broker do?

A mortgage broker is a professional who acts as an intermediary between you and potential lenders. The job of the mortgage broker is to work on your behalf with several banks to find mortgage lenders with competitive interest rates that fit your needs. They are well-versed in the industry and can provide you with tailored advice to help you navigate the complex mortgage landscape.

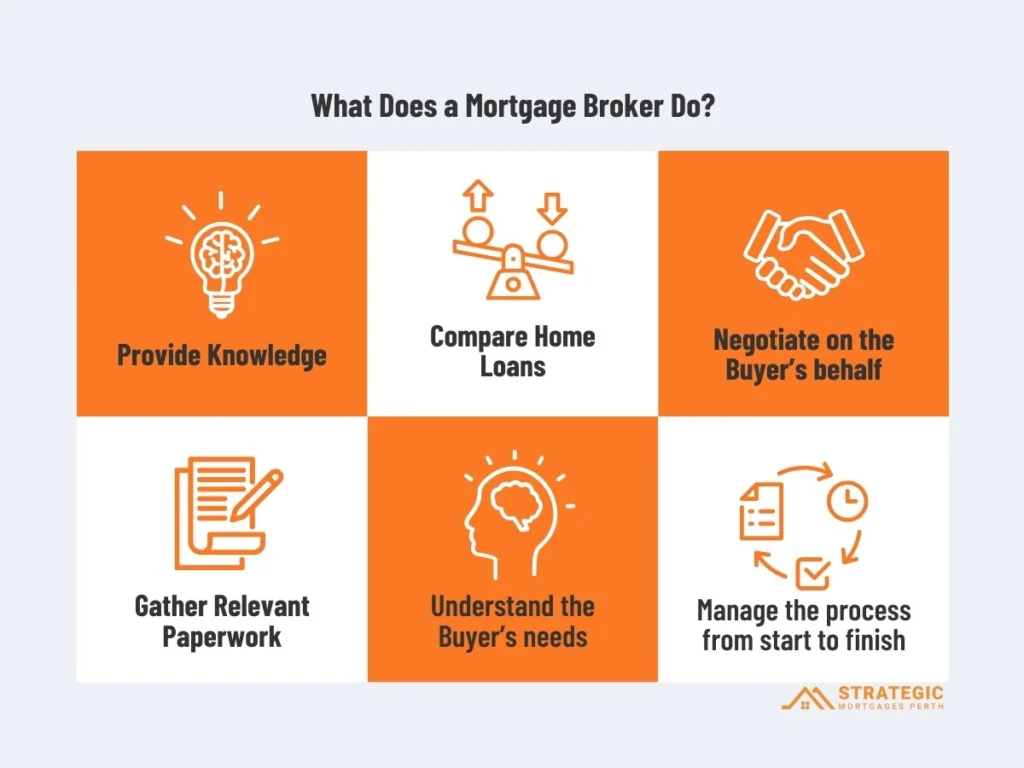

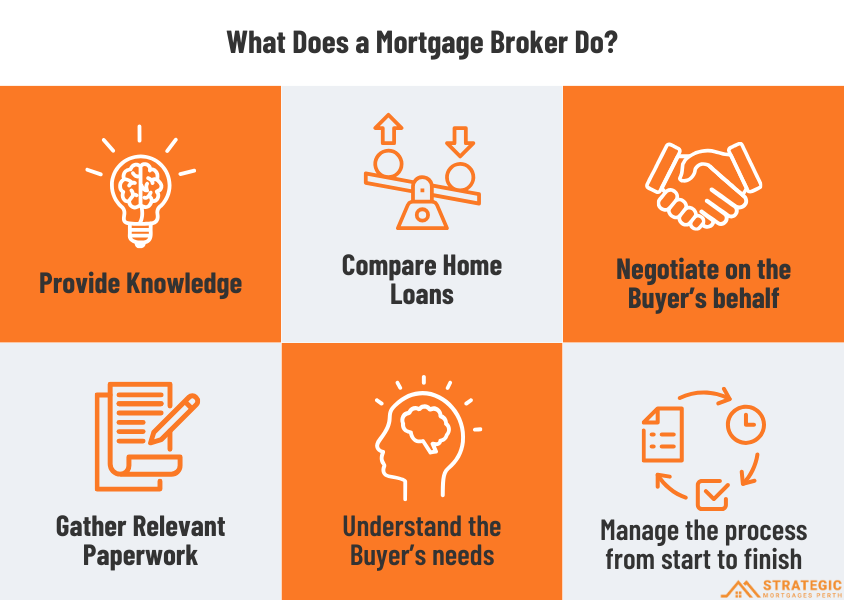

Some of the tasks mortgage brokers undertake include:

- Providing assistance and knowledge to a home buyer

- Listening to the home buyer and building a solid idea of their needs, wants and situation

- Comparing suitable home loans and buying options

- Negotiating with lenders on behalf of the buyer

- Gathering relevant paperwork as part of the borrowing process

- Guiding a buyer through the relevant paperwork

- Managing the entire process from engagement to settlement

A mortgage broker may also assist later in the home-buying process. For those who already have a home loan, brokers can help by refinancing their home loan for a better outcome.

What does a broker do when refinancing?

- Assesses the current home loan of the borrower

- Provides guidance and advice

- Identifies improved borrowing options on behalf of the borrower

- Manages the relevant relationships including potential and current lender

Above all else, the main thing a broker does is provide expertise, relationship management, and advice to home buyers.

Is it worth using a mortgage broker?

A mortgage broker can provide you with a range of options and help you find the best deal. They have access to a wide range of lenders and loan products, which you may not be able to find on your own. They also handle the application process, saving you time and effort.

Between July and September 2023, mortgage brokers wrote 71.5% of all new residential home loans and there’s a reason why. When it comes time to buy a home, there’s a lot to consider.

Across financial institutions, the growth of various suburbs, Australia’s economy, types of home loans, and more, the amount of information can feel overwhelming. That’s why brokers are often engaged, to cut through the clutter, and deliver on a range of benefits.

Your mortgage broker is on your side

Do you know that a mortgage broker is legally required to act in your best interests? The best interest’s duty (BID) is a government compliance framework that brokers and financial advisors are required to follow. It stipulates that brokers must always work in the best interests of their clients. This way, borrowers engaging a broker can have full confidence knowing they have a professional on their side.

This is unlike a bank representative, who is operating in the best interests of the bank and may not be focused on ensuring that you get the loan that is best suited to you.

A Perth mortgage broker knows your local area

For Perth buyers, a broker who understands Perth suburbs inside and out will be best equipped to provide the most valuable real estate advice possible. It’s not enough to know one suburb, a good broker will have a keen understanding of every suburb from Rockingham to Fremantle, Cottesloe to Hilary’s, and Como to Canning Vale.

Having a broker with an in-depth understanding of every suburb will give you the confidence you need when buying a home. With the ability to compare house prices, growth opportunities, economic trajectory and more, a broker will help you find the best spot to live comfortably along with finding a Perth home loan that matches your interests.

A mortgage broker has market insights (and will share with you)

With decades of expertise in local home ownership, a broker helps buyers make sense of the market, guided by financial, economic, and retail expertise. A good broker will provide buyers with the most relevant and up-to-date information impacting their home loan, allowing them to make the best possible decision and stay in the loop on their financial decisions.

Get Help from Perth’s Top Mortgage Brokers

Perth offers fantastic real estate opportunities for buyers – if you know where to look. With a home broker team that knows Perth inside and out, we can help you get financed and into a home we know you’ll love. Enjoy the views of the Swan River or look out to the trees of Kings Park, no matter where and how you like to live, our brokers can help you with a path to get there.