If you think your current home loan costs more than it should, it’s time to consider refinancing.

Every year we help borrowers and homeowners across Perth get better deals on their mortgages through our Perth home loan refinancing. During this process, we help our clients develop an understanding of what refinancing is, why it makes sense for them to be doing it, and what they can expect at every stage of the process. Below, we share some of these same expert insights, to help you understand your options.

What is Refinancing?

Refinancing is the act of changing the conditions of your loan to continue borrowing money under a different rate or terms. This can take the form of starting a new contract with a different lender or switching or altering the contract you have with your current lender. Refinancing occurs when a borrower believes that they could be receiving a better deal on the money they have borrowed, whether that be a reduced interest rate on the loan or more flexibility in how they pay it back.

An example of mortgage refinancing

Josh and Sarah, both 35, purchased their first home 7 years ago with a 10-year fixed-rate mortgage which came with repayment fees for exceeding expected repayments. At the time, they were grateful to secure the loan and become homeowners but since then, they have seen significant increases in their income and want to pay their home back faster.

With the help of refinancing, Josh and Sarah can move to a variable mortgage with no additional repayment fees, and make the most of their new financial success.

Why Refinance?

It’s not just a drastic pay rise that may cause you to consider refinancing your home loan, anyone who isn’t happy with their home loan, or could benefit from a switch, should consider the benefits of refinancing their mortgage.

Some of the key benefits that our Perth clients experience from their refinanced mortgages include:

- A reduced loan term, allowing them to be mortgage-free quicker.

- A reduced interest rate, generating extra savings over time.

- Improved financial flexibility and control of equity.

- Debt consolidation, to streamline debts and reduce the overall paid interest.

- Improved loan features from switching to newer loan types or offers.

- Improved experience with a new lender, such as improved support or ease of communication.

When to Refinance

Not everyone is ready or interested in refinancing. For some, home loan refinancing may sound appealing but they are not in a position to benefit from a refinance. In other times, refinancing may not have been considered, but they are in a great position to explore new options.

Below, we’ve put some of the most common situations that our clients are in when they decide they would like to refinance.

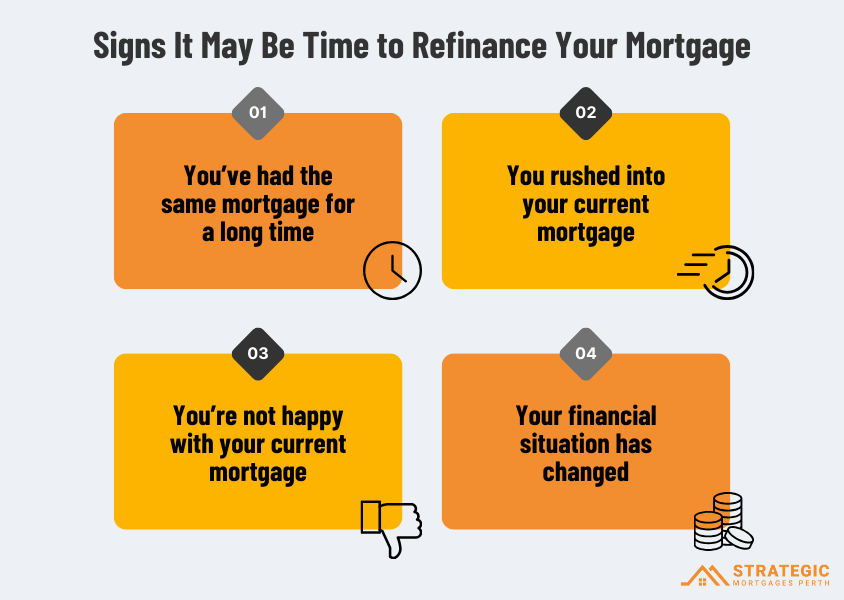

You’ve had the same mortgage for over 2 years

Today more financial information is available than ever before. With better analysis and comparison tools, todays local Perth and Australian mortgage brokers have more tools than ever before to help their clients get the best mortgage for them.

When you’ve had your mortgage for a long time, it’s worth taking a step back and reconsidering what other options have become available to you over the years. The types of mortgages and borrowing opportunities available to Perth homeowners are constantly changing, and staying aware of these changes is the best way to get more from your mortgage.

You rushed into your current mortgage

If you felt time-pressured to start your first home mortgage, you’re not alone. With many Perth residents finding the endeavour of homebuying and financing stressful and confusing, if you’re not working with a local home broker, it’s easy to jump into a mortgage that you’re not entirely happy with.

Now, a couple of years on, it makes sense to reconsider what you could be doing better. Without the stress of home buying, you can take your time to find a home loan that works with you and your lifestyle.

Your financial situation has changed

Whether for better – or for worse – a change in financial situation can often trigger the desire for a new home loan. An increase in your income or savings, or a change in your debt, can change the ideal type of home loan for you and make refinancing a worthwhile endeavour.

If you are struggling financially, ensure that you have professional advice and guidance on your remortgage. Without proper guidance, remortgaging can become more costly and less beneficial than staying in your current mortgage.

You’re not happy with your current mortgage

This is the most obvious – if you’re not feeling satisfied with your current mortgage – it’s time to consider refinancing.

Some common reasons people may feel unhappy in their current mortgage include:

- An unsatisfactory experience with their lender.

- High-interest rates and repayments.

- A lack of satisfactory suitable features and additions.

- High ongoing fees.

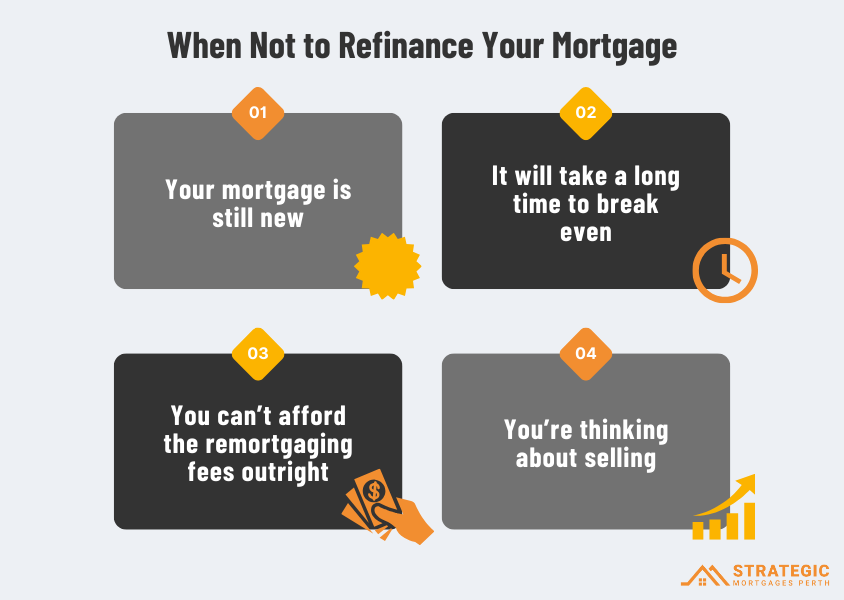

When Not to Refinance

Seeing a better deal elsewhere, or even undergoing a major life change, doesn’t always mean that it is time to seek out a new mortgage.

Some signs you may not be in a position to gain from refinancing include:

- Your mortgage is new – Refinancing a new mortgage (less than 2 years old) can incur extra costs and provide fewer options for switching.

- There’s a long wait to break even – If it’s taking you more than 6 years to break even on the switch for your mortgage, then you risk never fully recouping the initial costs of the switch.

- You can’t afford the initial remortgaging fees outright – These fees can include arrangement fees, booking fees and valuation fees.

- You’re looking to sell – If you have plans to sell, it becomes more likely that you won’t recoup the cost of switching home loans before your property is sold.

- You haven’t analysed the switch in-depth – When it comes time to refinancing, having all the facts is crucial to ensuring that you are making the right decision.

Is it good or bad to refinance?

Refinancing isn’t good or bad in itself, it’s whether you manage to refinance to your benefit that makes the difference. For some, refinancing can help save money, improve liquidity, boost savings and improve the ease of their home loan. For others, it’s an unnecessary extra cost with losses that they never recover.

The main difference between these two scenarios is the correct and accurate assessment of your situation and options. Without the right tools and understanding, refinancing can quickly spiral into a financial liability when it should have benefited you and your home loan.

Working with a local refinancing home loan broker can help you avoid this mistake, and provide you with a professional assessment of whether home loan refinancing is right for you.

Explore Your Options

If refinancing sounds appealing to you, then it might be time to take the leap and start exploring your home loan refinancing options.

Our team of expert, local Perth-based brokers, know all the ins and outs of home refinancing in Perth. Our relationships with over 30 lenders helps us find and identify the home loan which would be best suited to your situation, and our decades of combined expertise lets us advise you on whether or not you would benefit from the swap.

With personal guidance at every step, our team of experts can help simplify your refinancing process, while providing you with the knowledge and confidence you need to make the right decision.